However, the index soon pared most of its opening gains and spent the remaining part of session recouping those lost gains.

By the end of the session, Nifty managed to reach close to the high point of the session. The headline Nifty50 finally ended the session with net gains of 94.10 points, or 0.91 per cent.

The market is currently in a dicey situation. Global markets saw weakness in Friday’s session. This might result in a negative opening for the Indian market on Monday. Having said this, Nifty’s rise on Friday came with a very decent increase in net open interest (OI) in Nifty futures, which added over 9.96 lakh shares, or 9.37 per cent in OI. This showed fresh long buildup in the index. Volatility continued to cool off as volatility index INDIA VIX came off 3.34 per cent to 28.7350.

Monday’s session is likely to see a soft start. The 10,390 and 10,460 levels will act as overhead resistance, while supports will come in at 10,285 and 10,210 levels.

ET CONTRIBUTORS

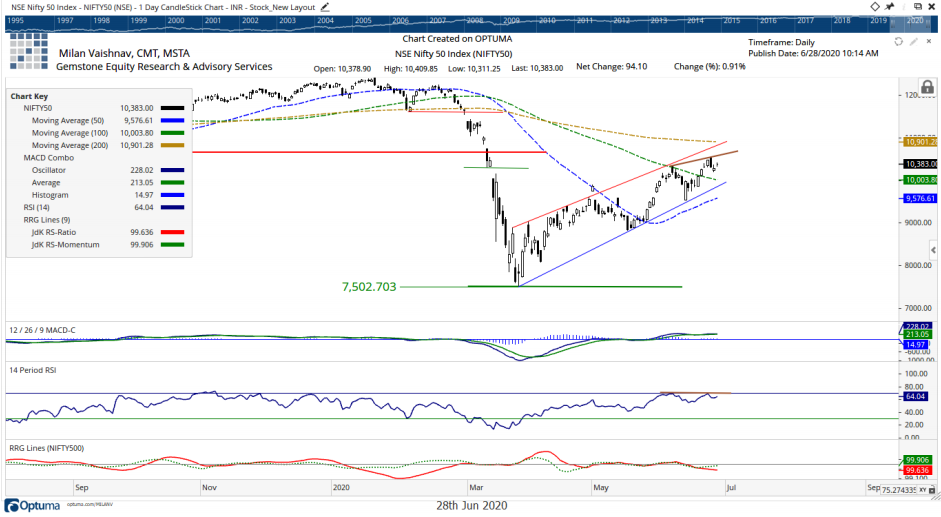

The Relative Strength Index (RSI) on the daily chart stood at 64.04. It remains neutral and does not show any negative divergence against the 14-day period. However, pattern analysis showed Nifty may be making a bearish divergence while marking a lower top. The daily MACD remained bullish as it continued to trade above the signal line.

A Doji appeared on the candles. Such a session with a near-similar open and close signals uncertainty and lack of conviction among market participants. If such a pattern appears during an up-move, it might signal a temporary halt to the current trend.

Pattern analysis showed Nifty has marked a lower top within a rising channel, and this is not a good sign. This lower top has come after the formation of a large bearish candle, which reinforced the credibility of this lower top. Unless this level is taken out, Nifty’s resistance levels might shift lower.

There are possibilities of both the scenarios emerging. The market may see a lower opening on Monday, and then see some recovery to from a lower top. Or it may see selling pressure at higher levels.

We recommend traders to not short aggressively in the event of a lower opening. In the case of any recovery from lower levels, one should refrain from making aggressive purchases as well.

On a broader note, the market will most likely remain rangebound. While staying extremely stock-specific, a continued cautious outlook is recommended for the session.

(Milan Vaishnav, CMT, MSTA, is a Consulting Technical Analyst and founder of Gemstone Equity Research & Advisory Services, Vadodara. He can be reached at [email protected])